Oman Colocation Market Revenue to Reach USD 88 Million by 2030 Underlines Strategic Moves by Global and Local Operators | Arizton

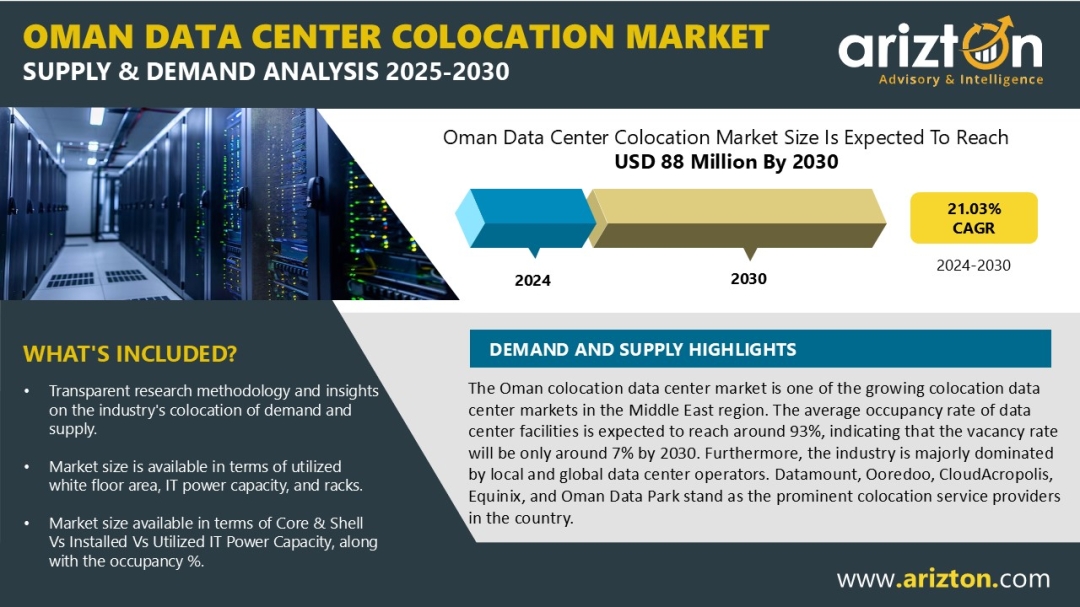

According to Arizton research, the Oman data center colocation market size was valued at USD 28 million in 2024 and is expected to reach USD 88 million by 2030, growing at a CAGR of 21.03% during the forecast period.

Explore the Full Market Insights: https://www.arizton.com/market-reports/oman-data-center-colocation-market

Report Summary:

MARKET SIZE - COLOCATION REVENUE: USD 88 Million (2030)

CAGR - COLOCATION REVENUE: 21.03% (2024-2030)

MARKET SIZE - UTILIZED WHITE FLOOR AREA: 271.35 thousand sq. feet (2030)

MARKET SIZE - UTILIZED RACKS: 6.285 Thousand Units (2030)

MARKET SIZE - UTILIZED IT POWER CAPACITY: 54 MW (2030)

BASE YEAR: 2024

FORECAST YEAR: 2025-2030

Investments and Innovation Propel Oman Colocation Data Center Growth

Oman data center colocation market is on a strong growth trajectory, valued at USD 28 million in 2024 and projected to reach USD 88 million by 2030, expanding at a CAGR of 21.03%. Leading operators, including Equinix and Ooredoo, are actively launching colocation facilities in Oman, boosting their market revenue share and strengthening the country’s position as a growing hub in the Middle East.

Occupancy rates are expected to reach around 93% by 2030, reflecting a highly sought-after colocation market with limited vacancy. The industry remains dominated by both local and international players, with Datamount, Ooredoo, CloudAcropolis, Equinix, and Oman Data Park emerging as the key service providers.

New entrants, such as Gulf Data Hub, are entering the market, expected to reshape competitive dynamics once their facilities become operational. In parallel, data center operators are increasingly adopting renewable energy solutions, signing power purchase agreements (PPAs) to support sustainable operations. Notably, Oman Data Park partnered with Solar Wadi in August 2025 to supply 1.4 MW of solar energy in the initial phase of its data center, highlighting the market’s commitment to green energy initiatives.

Why Oman Is Becoming a Hotspot for Colocation Investments

- Robust Submarine Connectivity: Oman is strategically connected with around 15 submarine cables, with five more expected by 2027, supporting high-speed, reliable data transfers across regions.

- Digital Transformation Initiatives: The 2021–2025 Digital Transformation Program is strengthening Oman’s digital ecosystem by building modern infrastructure, improving efficiency, and fostering a knowledge-based economy.

- Sustainability and Energy Efficiency: To address environmental challenges like cyclones and water scarcity, data centers are increasingly investing in renewable energy solutions to reduce their carbon footprint.

- Strong Data Privacy Framework: Oman’s adherence to the Personal Data Protection Law (PDPL) ensures secure data handling practices that meet international compliance standards, instilling investor confidence.

Oman Bold AI Push: Shaping the Future of Technology and Development

Oman, one of the developing countries in the Middle East, is making steady progress in adopting Artificial Intelligence (AI) to drive growth and innovation. In the past couple of years, the government has actively supported new AI startups and research centers, helping the sector gain momentum. In 2024, the total investment in Oman’s AI space reached around $156 million, showing growing confidence from both public and private sectors. In September 2024, Oman launched the National Programme for Artificial Intelligence (AI) and Advanced Digital Technologies (2024–2026), which focuses on using AI to improve economic and developmental sectors, localizing technologies, and ensuring governance that puts people first. As part of this effort, the country is also working on its first AI language model, further strengthening its position in the region’s AI landscape.

Oman Secure Growth Strategy: Driving Investment with Policy and Data Protection

The Oman government is actively building its infrastructure across key sectors such as manufacturing, ports, special economic zones, airports, education, healthcare, and tourism to attract global investors. It offers business-friendly tax policies, including a 15% corporate tax, no personal income tax, and duty-free trade across GCC countries, making it easier for companies to invest and operate. To support digital growth and protect user data, Oman introduced the Personal Data Protection Law (PDPL) in February 2023. The law, aligned with the EU’s GDPR, requires businesses to process personal data only with user consent and clearly explain how data is used, helping build trust and promote secure innovation.

Discover detailed insights and investment opportunities in Oman’s colocation data center market: https://www.arizton.com/market-reports/oman-data-center-colocation-market

Vendor Landscape

Existing Colocation Operators

- Equinix

- Ooredoo

- CloudAcropolis

- Datamount

- Oman Data Park

New Operators

- Gulf Data Hub

Related Reports That May Align with Your Business Needs

Israel Data Center Colocation Market -Supply & Demand Analysis 2025-2030

Turkey Data Center Colocation Market - Supply & Demand Analysis 2025-2030

What Key Findings Will Our Research Analysis Reveal?

- What is the count of existing and upcoming colocation data center facilities in Oman?

- How much MW of IT power capacity is likely to be utilized in Oman by 2030?

- Who are the new entrants in the Oman data center industry?

- What factors are driving the Oman data center colocation market?

Why Arizton???????????????????????????????????????????????

100%?Customer Satisfaction??????????????????????????????????????????????

24x7?availability – we are always there when you need us??????????????????????????????????????????????

200+?Fortune 500 Companies trust Arizton's report??????????????????????????????????????????????

80%?of our reports are exclusive and first in the industry??????????????????????????????????????????????

100%?more data and analysis??????????????????????????????????????????????

1500+?reports published till date????????????????????????????

?????????????????

Post-Purchase Benefit??????????????????????????????????????????

- 1hr of free analyst discussion??????????????????????????????????????????

- 10% off on customization???????????????????????

????????????????

About Us:???????????????????????????????????????????????????????????????????????????????????

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/oman-data-center-colocation-market

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Oman Colocation Market Revenue to Reach USD 88 Million by 2030 Underlines Strategic Moves by Global and Local Operators | Arizton

Information contained on this page is provided by an independent third-party content provider. XPRMedia and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact pressreleases@xpr.media